What if you only invested in Market Peaks? – Wealth of Common Sense

I’m Future Proofing this week with 4,000 friends in the financial advice space. Here’s a look back at the most popular post in the history of A Wealth of Common Sense.

*******

In 2014 I wrote a piece called What if you only invested in Market Peaks?

It’s hard to believe now, but many investors thought after the massive 30%+ performance in the S&P 500 in 2013 that the top was near.

So I decided to run the numbers as a way to imagine the outcome of an investor who invested his money at the market peaks, before the market crash.

I was more curious than anything and not sure what the results would show. They were surprisingly better than expected.

I didn’t think much of this article but it has become the most read piece of content I’ve ever written. It has been read almost a million times.

It still gets hundreds of thousands of page views a year.

I used this example in my book The Wealth of Common Sense but I always thought this story would be even better with visuals.

So with the help of our producer, Duncan Hill, I found an artist who could turn my story about the world’s worst market timer into a cartoon.

I updated some of the numbers, did some speech work, got a sample of how we wanted it and Duncan put it all together.

Here is the finished product:

Most people who read my original piece understand that it is just an anecdote used to discover the importance of taking a long-term view of investing.

But there was a lot of push back.

What about Japan?

What if stock returns are not good going forward?

What if the world ends?

There are always risks involved with any investment strategy but I believe that thinking and acting for the long term gives you the greatest margin of safety of any strategy.

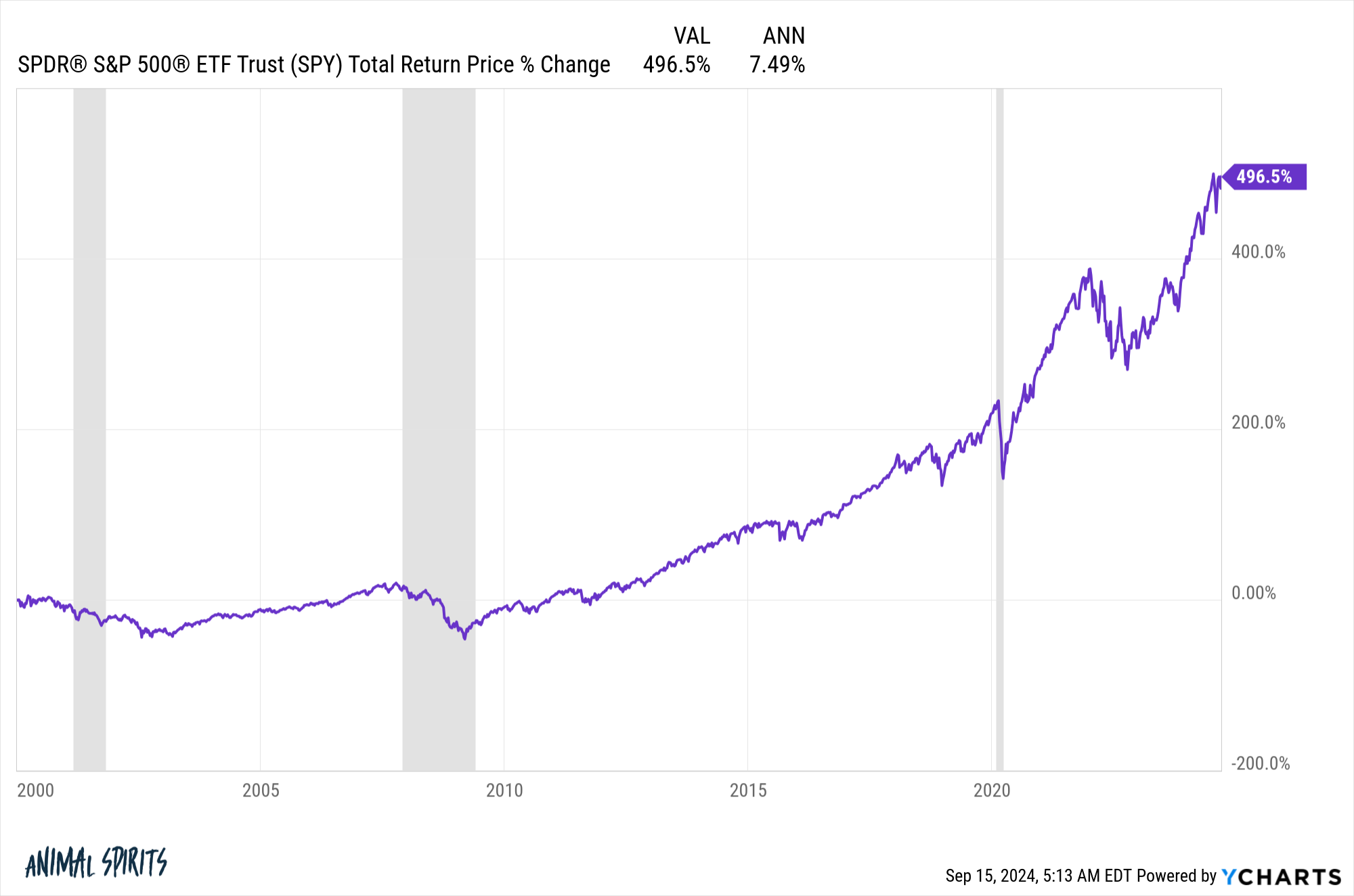

For example, if you had invested in late 1999 when the CAPE ratio hit an all-time record of nearly 45x, that may have been the worst point in the history of the US market.

You would have been forced to live through the crash that followed from the dot-com bubble, the 2008 crash and this year’s Corona crisis. That’s two times to see the stock market cut in half as well as a 4-week period where it fell by a third. All after twenty years.

And what would you have to show for it?

Not great returns but certainly not terrible over 20+ years.

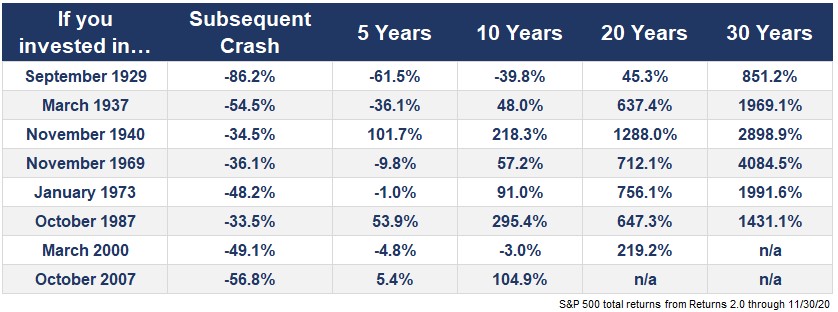

Following this article, I looked back at the long-term returns when I invested at the peak of the market before a major crash or bear market:

There were lean times there, especially after the Great Depression. But in general, the long-term return, even from the height of the market peaks, looks very good.

I am not suggesting that investors owe anything for the long term. The stock market is and remains a risky proposition, especially in the short to medium term.

But if you have a long enough horizon and are willing to be patient, the long term is still a good place to invest in the market.

Further Reading:

What if you only invested in Market Peaks?

This content, which contains opinions related to security and/or information, is provided for informational purposes only and should not be relied upon in any way as professional advice, or endorsement of practices, products or any services. There can be no guarantee or warranty that the opinions expressed herein will be applicable for particular facts or circumstances, and should not be relied upon in any way. You should consult your own advisors regarding legal, business, tax and other matters related to any investment.

Comments on this “post” (including any related blogs, podcasts, videos, and social media) reflect the views, opinions, and reviews of Ritholtz Wealth Management employees who provide views are, and should not be construed as, the views of Ritholtz Wealth. Management LLC. or its various affiliates or as a description of the advisory services provided by Ritholtz Wealth Management or the performance returns of any client of Ritholtz Wealth Management Investments.

References to any assets or digital assets, or performance data, are for informational purposes only, and do not constitute an investment recommendation or an offer to provide investment advisory services. The charts and graphs provided herein are for informational purposes only and should not be relied upon in making any investment decision. Past performance is not indicative of future results. The content only refers to the date shown. Any values, estimates, projections, expectations, expectations, and/or opinions expressed in these articles are subject to change without notice and may differ or contradict the opinions expressed by others.

Compound Media, Inc., a subsidiary of Ritholtz Wealth Management, receives payment from various agencies for advertisements on affiliate podcasts, blogs and emails. The inclusion of such advertisements does not imply or imply endorsement, sponsorship or encouragement thereof, or any affiliation with it, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Financial investments involve the risk of loss. For additional advertising disclaimers see here: https://www.ritholzwealth.com/advertising-disclaimers

Please see the disclosures here.

#invested #Market #Peaks #Wealth #Common #Sense